Thank you for looking to donate to Isle of Wight NHS Trust Charity

We would like to make it as easy as possible for you to donate so please see below a range of ways to donate to suit you best.

Online Donation

You can donate online via our Enthuse page, please click below

Making a donation in memory of a loved one

If you would like to set up a tribute page in memory of a loved one, please click the link below

Set up a donation page in memory of a loved one

Donating in the post

Please make cheques payable to 'Isle of Wight NHS Trust Charity' and send with a cover letter explaining the donation and if you would like the money to go to a specific ward or department. Please post to:

Donating cash in person

Please do not send cash in the post. If you are onsite at St Marys Hospital, please include your details and if you would like the money to go to a specific ward or department you can drop cash off to the Cashiers Office, in the entrance to the hospital.

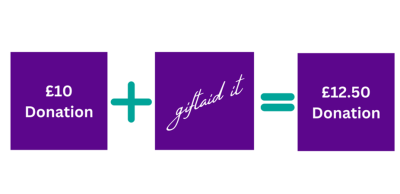

Help to make your donation worth 25% more in Gift Aid

What is Gift Aid?

Gift Aid is a government scheme which enables registered charities in the UK to claim the tax back from HMRC on the donations they recieve.

How it works

If you are currently a UK taxpayer and you fill out a Gift Aid declaration when you donate, we can claim back 25p for every £1 that you donate. Once signed, your Gift Aid declaration is valid for all your gifts in the future and for any gifts you have made in the last four years.

To declare all donations please contact us at iownt.

Declaration in detail

If you are a UK taxpayer and you would like Isle of Wight NHS Trust Charity to reclaim tax on the donations made in the last four years and any future giving you decide to take part in, you must first understand that if you pay less income or capital gains tax than the amount claimed on all donations in that tax year (April 6 – April 5) it is your responsibility to pay any difference.

Please note that Gift Aid cannot be claimed by one individual on monies collected from multiple donors. e.g. birthday collections.

Please notify Isle of Wight NHS Trust Charity if you want to cancel this declaration, change your name or full home address, no longer pay sufficient tax on your income or capital gains. If you are a higher rate taxpayer, you can claim personal tax relief via a self-assessment tax return or ask HM Revenue and customs to adjust your tax code.

You can make a declaration and join the scheme by post or by email. You will have 30 days to cancel, if necessary, before a claim is made. You can cancel at any time after that should your circumstances change.

You can read the HMRC's full guidelines here.

Thank you very much for your donation.